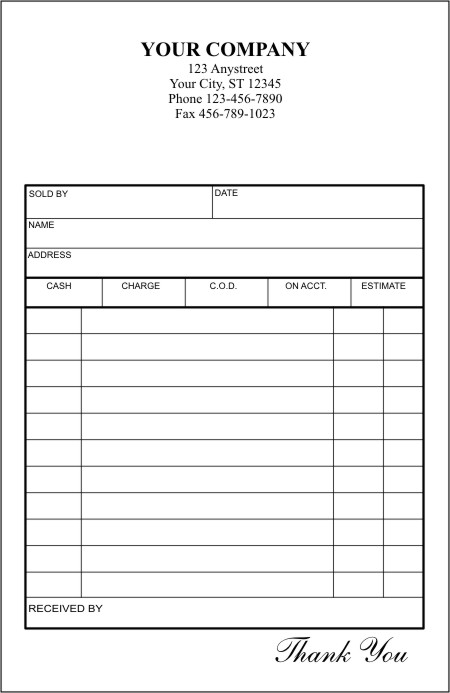

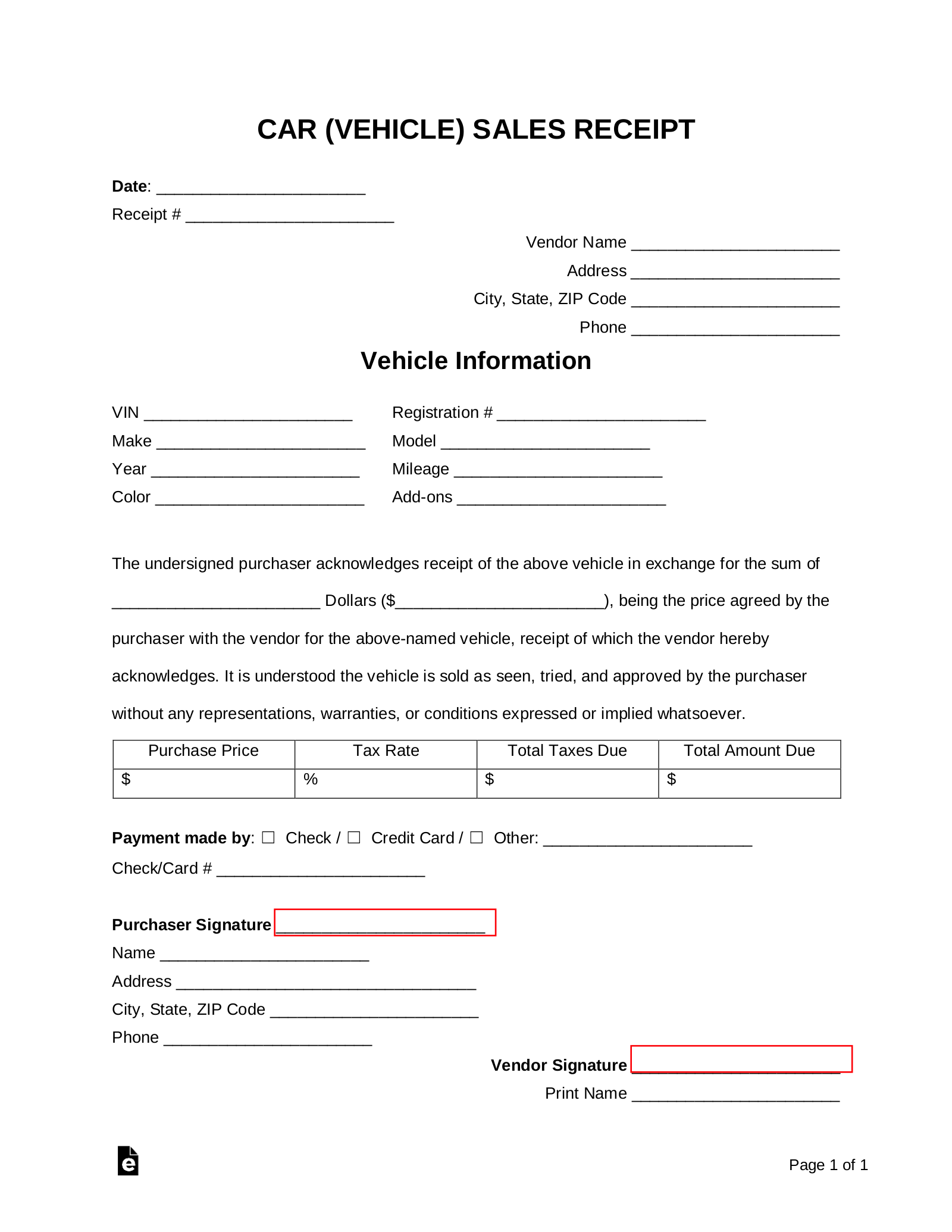

Note: Your browser may ask you to allow pop-ups from this website. Expand the folders below or search to find what you are looking for. More information on this standard is available in FYI-206: Gross Receipts Tax and Marketplace Sales.įor a complete overview of the gross receipts tax, see FYI-105: Gross Receipts and Compensating Taxes: An Overview.įYI-102: Information for New Businesses Gross Receipts Tax Workshopsĭirections 1. Please see FYI 200 for more information on choosing the correct location and tax rate for your receipts.īusinesses that do not have a physical presence in New Mexico, including marketplace providers and sellers, also are subject to Gross Receipts Tax if they have at least $100,000 of taxable gross receipts in the previous calendar year. A sales receipt is a transaction record that the seller issues at the time of sale to verify the provided product or service and the amount the buyer paid.

#Sales receipts license#

‘Professional services’ are services that either require a license from the state to perform or require a master’s degree or better to perform. How Does a Sales Receipt Work Whenever a customer purchases a product or. One exception is if the services performed meet the definition of ‘professional services’ found in statute. An electronic or paper record of a transaction, generated at the point-of-sale.

#Sales receipts code#

The Department posts new tax rate schedules online and in the GRT Filer’s Kit, which can be found at the bottom of this page.īusinesses will generally use the location code and tax rate corresponding to the location where their goods or the product of their services is delivered. The business pays the total Gross Receipts Tax to the state, which then distributes the counties’ and municipalities’ portions to them.Ĭhanges to the tax rates may occur twice a year in January or July. It varies because the total rate combines rates imposed by the state, counties, and, if applicable, municipalities where the businesses are located. The Gross Receipts Tax rate varies throughout the state from 5% to 9.3125%. Although the Gross Receipts Tax is imposed on businesses, it is common for a business to pass the Gross Receipts Tax on to the purchaser either by separately stating it on the invoice or by combining the tax with the selling price. Gross receipts are the total amount of money or other consideration received from the above activities. Selling research and development services performed outside New Mexico, the product of which is initially used in New Mexico.Performing services in New Mexico, and performing services outside of New Mexico, the product of which is initially used in New Mexico.Granting a right to use a franchise employed in New Mexico.

0 kommentar(er)

0 kommentar(er)